Training breeds trust for Nordic insurer

Customer experience means everything in insurance. A business only survives and thrives if it inspires deep trust with its clients.

After all, buying insurance is different from choosing other consumer products. It is a purchase where the buyer seeks peace of mind, long-term security for their family, and life-long protection for their loved ones and their biggest assets.

Buying insurance is potentially the start of a relationship with a brand that can last a lifetime.

Strategically vital

This means that the interaction between the firm’s representatives and the customer are critical – especially in the first call or encounter when impressions are formed.

The entire commercial health of the company rests on getting those conversations just right.

That’s why If P&C Insurance – serving 3.8m people in Sweden, Norway, Finland, Denmark, Estonia, Latvia and Lithuania – set out to transform their training to sharpen the skills of its public-facing staff.

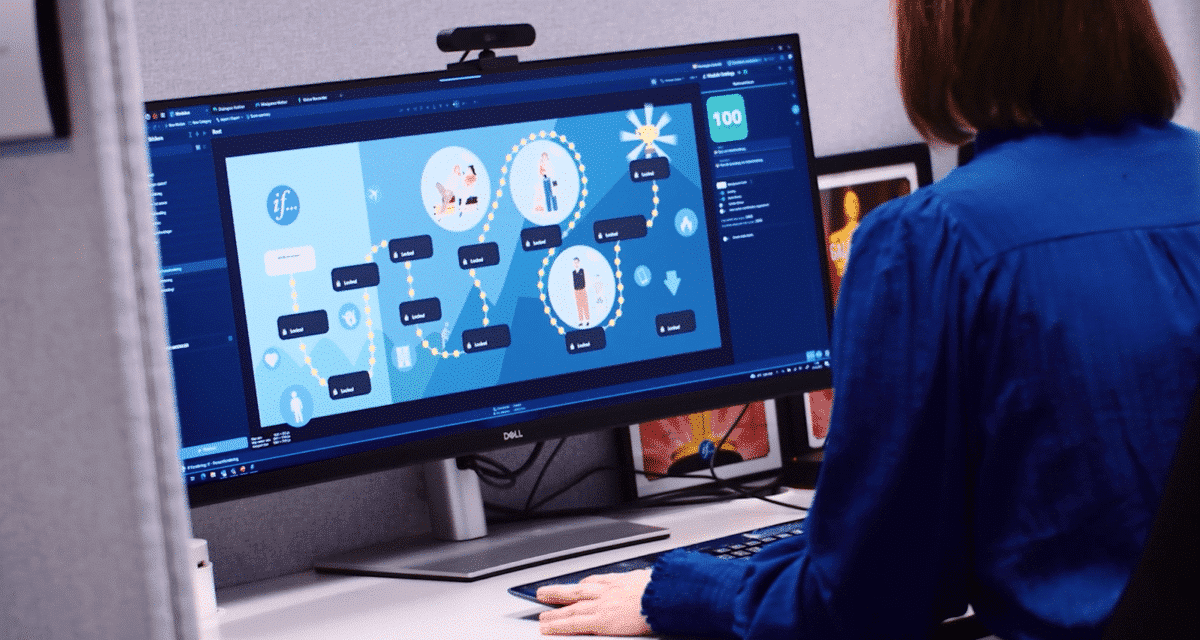

They chose Attensi gamified simulation training for the strategically-vital job.

Task – the perfect policy every time

If P&C’s aim is to make sure every customer receives the perfect package of products to suit them and their family.

It’s not always easy to find the right blend of policies right away – it takes careful listening and tactful conversations to discover what best suits the caller’s unique circumstances.

Those kinds of personal skills are best-suited to gamified training, because the learner can work though realistic scenarios over and over using avatars and realistic 3D simulations, in a safe, risk-free environment away from the stress of actual calls.

Offering options

It helps the employee learn how to ensure customers get the best advice, which is vital for the long-term relationship with the customer. The staff member knows which cover best matches the client’s requirements. It won’t sell any product they don’t need.

One of the priorities for the training was ensuring that advisers remember that most callers ask specifically about house or motor insurance. Often they neglect personal insurance, which can leave them exposed to the risk of loss or financial difficulty if they or a family member suffers some kind of harmful event or accident.

The gamified training focuses on finding out potential gaps in the customer’s insurance – and offering options for providing a comforting blanket of cover, while avoiding potentially unethical and brand-damaging hard selling.